Spark Infrastructure, the partial owner of SA Power Networks, Transgrid, Powercor, CitiPower and the Bomen Solar farms is looking at developing a 2.5GW renewable energy hub in the middle of the South West Renewable Energy Zone (REZ) in NSW.

The Dinawan Energy Hub is strategically situated along the route of the planned interconnector between South Australia and NSW. The EnergyConnect project will be a 330KV interconnector running between Wagga Wagga and Robertstown in South Australia and will open up more than $20B of new renewables projects.

The Dinawan Energy Hub will be located halfway between Coleambally and Jerilderie and due to its location will support the existing network and the Humelink and Karanglink interconnectors.

The hub is expected to be completed by 2025 and is expected to include 1GW of wind, solar and battery storage. The $1.5B project will be undertaken in stages with the first stage expected to

commence construction in 2024.

Spark Infrastructure have completed the project identification stage of the development and now will undertake engineering studies and community consultation. The final investment decision is expected in 2024.

In some ways the Dinawan Energy Hub will compete with the NSW government’s plans to develop the REZ however Spark infrastructure believe the REZ and the energy hub can be developed together.

Spark Infrastructure is also in the news with a potential takeover bid for the multi-billion-dollar business.

Leading global investors including Kohlberg Kravis Roberts (KKR) and Ontario Teachers’ Pension fund have showed interest in investing in renewable energy and infrastructure projects in Australia.

It is understood these investors are looking at investing $5B to take over Spark Infrastructure.

If the takeover goes to plan, KKR and Ontario Teachers’ Pension Plan may add the Australian market to their target markets having recently bought a stake in Finland’s largest electricity distributor. KKR is also in the process of buying John Laing, a developer with interest in renewables assets in Australia.

Back in 2017 following the black out of South Australia, the Tesla big battery was announced as the largest lithium-ion battery in the world. Weighing in at 100MW/150MWh the unit was big and provided enough storage to get regions through short duration period of high price of low availability. At the time, most people in Australia thought of batteries as a small segment of the industry and did not predict batteries to make any meaningful impact on the market for the next 10 to 20 years.

Back in 2017 following the black out of South Australia, the Tesla big battery was announced as the largest lithium-ion battery in the world. Weighing in at 100MW/150MWh the unit was big and provided enough storage to get regions through short duration period of high price of low availability. At the time, most people in Australia thought of batteries as a small segment of the industry and did not predict batteries to make any meaningful impact on the market for the next 10 to 20 years. A constraint designed to maintain power flow in the Gladstone region, primarily to maintain the continuous current rating on the 132kV feeder bushing at Boyne Smelter, is constraining off hundreds of MWs in Queensland.

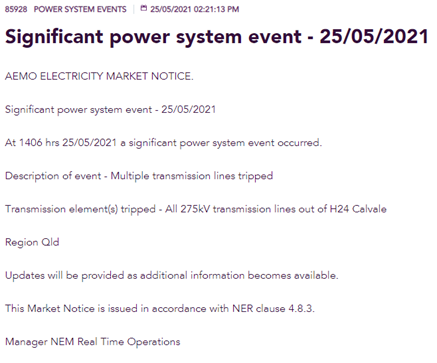

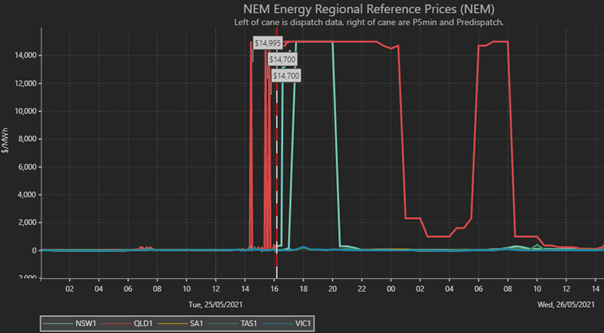

A constraint designed to maintain power flow in the Gladstone region, primarily to maintain the continuous current rating on the 132kV feeder bushing at Boyne Smelter, is constraining off hundreds of MWs in Queensland.

Just weeks after the evacuation of Callide Power Station we have seen another thermal power station evacuated and units shut down.

Just weeks after the evacuation of Callide Power Station we have seen another thermal power station evacuated and units shut down.