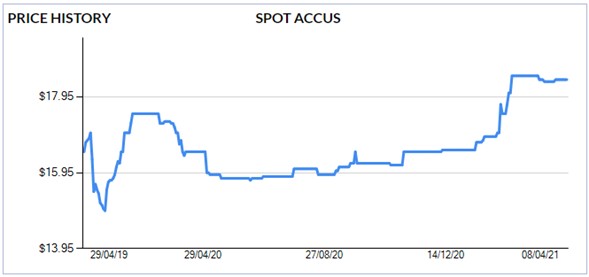

As the next round of auctions are set to take place under the Emissions Reduction Fund, prices for Australian Carbon Credits (ACCU) have increased steadily since January and are now trading at $18.40 per certificate, 10% higher than in January.

The growth in the ACCU market is partially from the Federal government’s Safegaurd mechanism, but also due to an increasing number of companies implementing zero emission targets and using ACCU’s to offset their emissions.

As more companies choose to aim for a net zero emission position, the supply / demand balance in the ACCU market has shifted and the price of the commodity is increasing. Some forecasts predict ACCUs could reach as high as $45 per certificate by 2030.

The biggest jump in the price for ACCUs was recorded in February when the Prime Minister endorsed a net zero target by 2050.

As highlighted in previous articles, many companies are responding to shareholder pressure to reduce emissions and decarbonise. The European market, Emissions Trading System (ETS), a block of 27 countries, has seen EU carbon permits jump from €23 in November to €41 in March. They were trading closer to €5 only two years ago. The price increase has been the result of the EU’s tougher climate change policies.

Large emitting companies had until February 2021 to purchase their ACCUs to comply with their Safeguard liabilities, hence the increases in price. However as seen from the chart above the prices of ACCUs has remained high. This leads to the assumption that voluntary purchases of ACCUs are maintaining upward pricing pressure.

Across Australia, large emitters such as AGL have been joined by large energy users including the Coles Group and Woolworths to commit to net zero greenhouse gas emissions by 2050. Other large gas and petrochemical exporters have started to sell carbon neutral LNG and other carbon neutral products, this is achieved by carbon offsets such as ACCU’s.

As the demand for carbon offsets increases the ACCU price is likely to continue to rise until cheaper abatement solutions develop such as improved farming practices resulting in improved soil carbon storage and broad acre management such as Savanna burning.

Common to all markets, the offset market is currently in a state of flux. Demand will most likely increase the price of ACCUs while new project and pressure from international carbon offsets will put downward pressure on prices. The positive takeaway is businesses are clearly proactively moving to reducing their carbon footprint.