The Australian Energy Market Commission (AEMC) has released its annual residential electricity price trends report. The report provides governments and consumers with an understanding of the cost components across the electricity supply chain and provides transparency into the final price by consumers. It also provides a forecast of the costs for the next 3 years.

In the 12th version of the report, the AEMC found there is a general trend of residential bill reductions. Queensland is expected to see the largest drops, with a projected drop of 10% while the only region to increase is the ACT with an increase of 4%.

The 10% savings for Queenslanders are expected to translate on average to a savings of $126 which will see electricity bills the lowest since 2010/11.

The key drivers in an electricity bill are the wholesale, environmental and network costs. Wholesale costs are likely to fall by $36 over the 3 years, environmental costs will also drop by around $35 due to the increased reliance on renewable generation however the network costs are likely to increase by 3.4% or $21 over the 3 years due to the increased investment in the transmission and distribution networks.

AEMC Chair Anna Collyer said, “the report shows that, based on current trends, prices per kilowatt hour are likely to be under 26c p/kWh by June 2024, the first time since 2016/17”.

The report gives enough visibility into the future that claims that the cost of power delivered to consumers will drop and continue to trend down despite the closure of large thermal power stations.

Even though wholesale and environmental costs are trending down the cost of network investments will transfer into higher network costs as investments are made into the network to strengthen the grid and allow for the two way connection of distributed generation.

An interesting comment from the AEMC is that environmental costs are expected to drop by $16 out to FY23/24 due to a decrease in large-scale renewable energy costs. We are seeing a trend in the short term of environmental costs increasing due to delays in the construction and commissioning of new generators. We are also seeing an increase in the cost of LGC’s as more companies choose to buy extra certificates for voluntary surrender.

The head of the AEMC also said “While we have just under 2,500MW of generation expected to exit the grid over the next three years, there are almost 5,500MW of committed new large-scale generation and storage projects coming online over the same time period,”

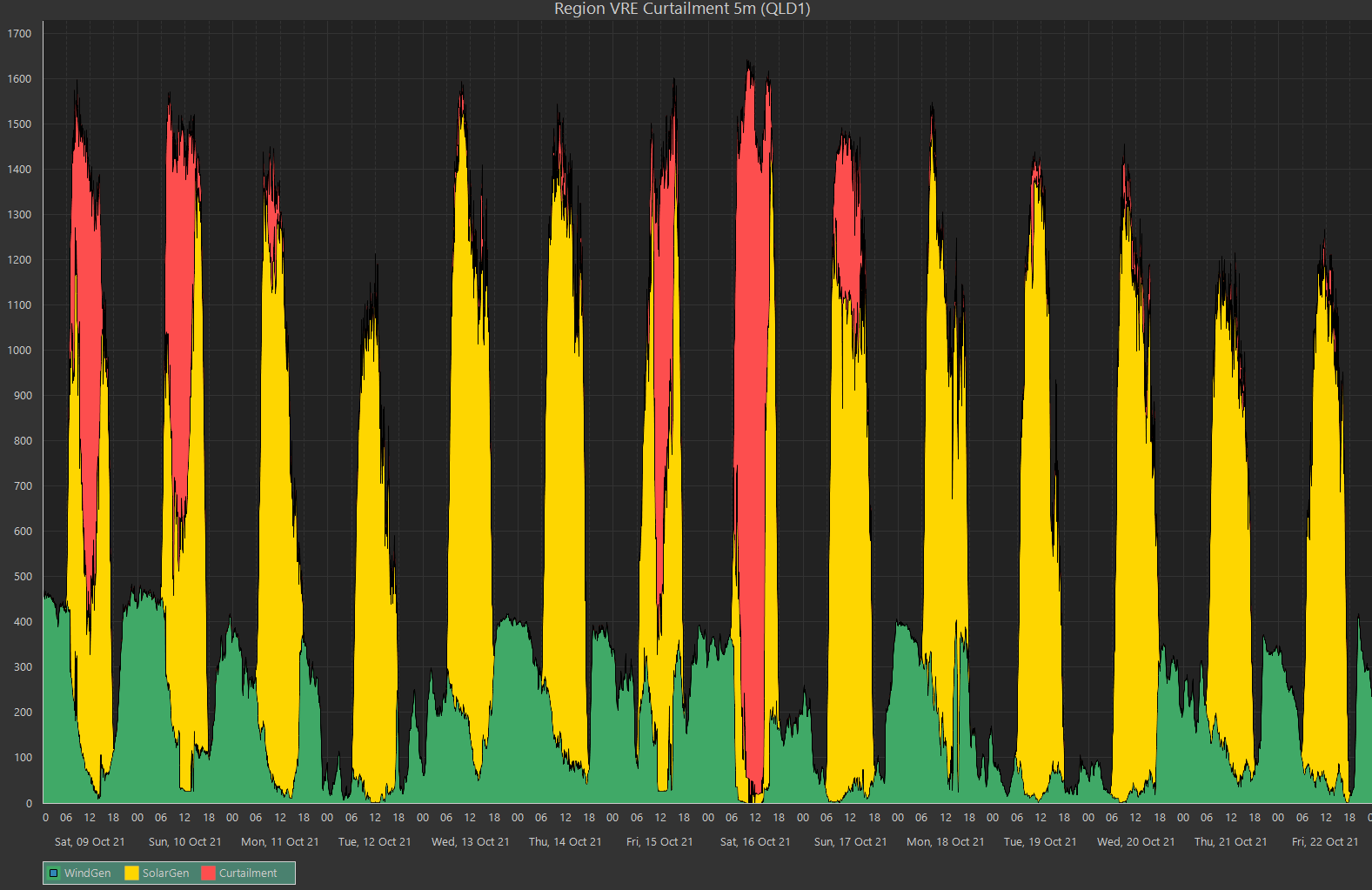

With the addition of a further 4,130 MW of new rooftop PV capacity, this is likely to push prices down however until the network is reinforced it may have the opposite effect.

Edge has reported over the last couple of years that the cause of some of the market volatility has been because of the unconstrained rooftop PV lowering the operational consumption and disporting the scheduling of generation throughout the NEM.

The next 3 years may be the most crucial in the transition of the NEM from thermal generation to renewables and the investments in getting the network in place will be passed on to end users.

The question is, do consumers want the cheapest power in the short term or is a grid designed to provide the cheapest energy for the long term, the answer?

Article written by

Alex Driscoll

On Thursday last week, Australia’s largest energy company released its annual report. The 192-page document contains a lot of information but not a lot of good news for investors. One of the sections is titled “a year of continued evolution”, first there was the planned demerger, then the exit of its CEO following the demerger announcement, now to cap it off the news of on-going challenging market and operating conditions due to declining wholesale electricity prices.

On Thursday last week, Australia’s largest energy company released its annual report. The 192-page document contains a lot of information but not a lot of good news for investors. One of the sections is titled “a year of continued evolution”, first there was the planned demerger, then the exit of its CEO following the demerger announcement, now to cap it off the news of on-going challenging market and operating conditions due to declining wholesale electricity prices.