Energy Networks Australia (ENA) represents Australia’s electricity transmission, distribution networks, and gas distribution networks. The Australian Energy Council (AEC) represents generation companies. Recently, ENA and the AEC have engaged Cambridge Economic Policy Associates (CEPA) to investigate the governance arrangements of Australian Energy Market Operator (AEMO) within the National Electricity Market (NEM).

The AEC and ENA raised concerns over AEMO’s expenditure on transition studies and planning. Specifically, the pace of change proposed by AEMO and their approach to new technologies such as virtual power plants and new market mechanisms.

CEPA reviewed similar government models from international market operators and has now proposed alternate models. Among the suggested new models were options to make AEMO answerable to the Australian Energy Regulator (AER). CEPA suggested that a budget and planning committee with members from AEMO and member representatives could be created.

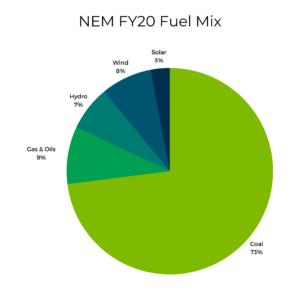

It appears that these actions have come off the back of AEMO’s recently published Integrated System Plan (ISP). The ISP mapped out AEMO’s pathway to a shift to renewable energy within 20 years. AEMO commented that thanks to Australia’s fleet of ageing and increasingly unreliable coal generators, there is a need to transition to a renewable energy future. The only thing that could deliberately slow down this transition would be due to industry or government policy changing. AEC members want to hear this as they are heavily invested in coal fire generation assets and, in recent times, gas powered generation.

Renewable advocates have viewed this review as a way for thermal generators to slow down the regulatory process. By including the AER in decision making, they are reducing competition from renewable generators. The renewables industry sees the AEC as a pro-thermal generation body. Their Chief Executive Officer (CEO), Sarah McNamara previously worked as Senior Energy Policy Advisor for Tony Abbott. Prior to this, she worked for AGL’s Corporate Affairs team as well as anti-renewable lobbies, Ian MacFarlane.

ENA members have been more positive towards AEMO’s ISP as they see the benefits of more transmission infrastructure. However, some members in the distribution business see a threat on the lower voltage networks by rooftop solar, battery storage and Electric Vehicles.

AEMO have also been offside with the renewable industry in its role responsible for Victorian grid connections. Last minute changes to connection requirements and agreements has caused delays and reductions in projects. Market participants, including end users, are also unhappy with AEMO following recent budget increases.

AEMO has been spending more money on projects such as the ISP, research and the development of new market mechanisms that will favour new technologies such as batteries and virtual power plants. The budget was set at $241 million this year which was an increase of 12% on previous budgets. Prior to this, fees generally remained static or increased by Consumer Price Index (CPI). AEMO have defended these increases by saying that the volume of rule changes in the NEM has tripled in the last three years. They stated that virtually all the rule changes have directly impacted them.

Queensland Energy Users Network (QEUN), a prominent consumer advocate in Queensland, have also come out against AEMO. They noted that AEMO’s total costs amounted to eight cents a week to the average consumer. They believe that development of the market should not be at the expense of the Australian economy, jobs, or reasonable living standards. QEUN suggested that AEMO sticks making sure the lights are kept on. They essentially told AEMO to stay quiet about any big plans for the future.

Written by: Alex Driscoll

To keep up-to-date with Edge Utilities, connect with us on LinkedIn: https://www.linkedin.com/company/edge-utilities/

Read our latest article: https://edgeutilities.com.au/changes-to-the-generation-mix/