On Thursday August 27th, 2020, the Australian Energy Market Operator (AEMO) published its latest Electricity Statement of Opportunities (ESOO). The ESOO is a 10-year projection of electricity supply reliability in the National Electricity Market (NEM).

In July 2019, the Australian Energy Regulator (AER) introduced the Retailer Reliability Obligation (RRO). The RRO was introduced to provide stronger incentives to market participants for investing in technologies that will improve the reliability of the NEM. AEMO uses the ESOO to identify gaps in the NEM’s reliability. Over the next 5 years, AEMO will work with the AER if there is a significant gap identified in reliability. As the ESOO covers the next 10 years, the second 5 years following the RRO looks closer at forecasts for the major transmission upgrades and the continued development of renewable generation.

COVID-19 and other impacts

This year’s ESOO has assessed the impact that COVID-19 had on the NEM. It also looks at what affect this could potentially have on the outlook’s uncertainty. COVID-19 combined with the change in generation mix, demand changes, and gas market changes has provided a positive outcome. Due to these changes, AEMO has forecasted no unserved energy (USE) for the upcoming summer season. Unserved energy is a measure of the amount of customer demand that cannot be supplied within a region. This happens due to a shortage of generation, demand-side participation or interconnector capacity.

The ESOO will require an update if life after COVID-19 returns to normal faster than expected. AEMO has also stated a few points of concern relating to the delays or deferment of planned outages that could affect reliability over summer.

ElectraNet, South Australia’s high voltage transmission network specialists, have reduced the summer rating on the Victoria to South Australia Interconnector. This reduction follows the damage incurred during the bushfires in the beginning of 2020. One downside of the reduced flow across the interconnectors, is further delays in the commissioning of renewable projects across the regions. This means that AEMO may need to deploy the Reliability and Emergency Reserve Trader (RERT) to manage the contingency events resulting in USE.

A new focus

After summer, the focus will shift to look at the reliability in NSW. This will be following on from the retirement of the Liddell Power Station. The outlook on this has improved since last years’ ESOO, with the augmentation of the Queensland to New South Wales Interconnector (QNI). This will take place in 2022-2023 and aims to increase renewable generation development in the region.

By 2025, minimum operational demand will change from the overnight period to occur at midday. This is due to an increase in rooftop solar panels and batteries. This will lead to challenges when managing voltage, system strength and inertia. AEMO has recognised this and are working with aggregators of Distributed Energy Resources (DER) to offer services such as increased photovoltaic (PV) controllability, load flexibility, storage, and load shifting.

New projects moving forward will require all new distributed PV installations to have suitable disturbance ride-through capabilities and emergency PV shedding capabilities. This will cause increased costs and delays in commissioning the projects.

AEMO is working with various stakeholders and industry experts to ensure energy supply is protected from the effects of increasing frequency, extremity and scale of climate induced weather events that have been observed in prior years. The NEM will continue to see a large quantity of renewable generation connections. Approximately 4,300 MW of new capacity is forecasted to be operational this summer and 1,900 MW of this is expected to be in Victoria alone.

A more realistic outlook on Summer

As COVID-19 is unpredictable, AEMO have warned that there is risk in their forecast regarding no USE this summer. Due to this, there is a level of uncertainty regarding the supply of electricity during the coming summer. Although, AEMO have still not seen a requirement to contract the volume of long-term RERT as seen in previous years. If renewable generators do experience delays, AEMO will continue to outsource short-term RERT suppliers as an emergency backup.

The Bureau of Meteorology (BOM) are forecasting La Niña this summer. This occurs when equatorial trade winds become stronger, the ocean surface currents change. This then draws cooler deep water up from below. La Niña will result in a cooler, wetter climate for this year’s summer. Because of this, we are likely to see less stress on the supply/demand balance this summer.

Federal Energy Minister, Angus Taylor has referenced this years’ ESOO in a recent statement. He informed Australians that households and businesses will have reliable electricity moving forward. However, AEMO have tempered this statement commenting that there may be issues after 2023 if capacity does not increase. Although there are fewer planned outages for coal and gas generators this summer, COVID-19 may extend repair times. Due to this risk, AEMO is taking everything they can get as an emergency backup under the RERT scheme.

Written by: Alex Driscoll

Read our article on the recently published Integrated System Plan (ISP) here: https://edgeutilities.com.au/2020-isp/

To keep up-to-date with Edge Utilities, connect with us on LinkedIn: https://www.linkedin.com/company/edge-utilities/

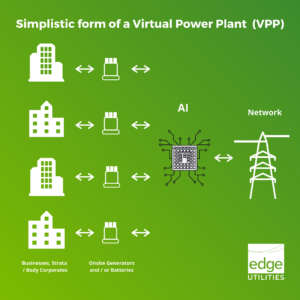

Many of you would have seen the acronym VPP floating around the energy industry, in AEMO documents and publications like the Integrated System Plan (ISP). So, what is a VPP? A Virtual Power Plant (VPP) is basically an aggregation of resources. These can be generation, storage and controllable load from decentralised sources. All being coordinated to deliver services to the power grid including electricity, FCAS and other power system services.

Many of you would have seen the acronym VPP floating around the energy industry, in AEMO documents and publications like the Integrated System Plan (ISP). So, what is a VPP? A Virtual Power Plant (VPP) is basically an aggregation of resources. These can be generation, storage and controllable load from decentralised sources. All being coordinated to deliver services to the power grid including electricity, FCAS and other power system services.