What is the Inegrated System Plan?

The Australian Electricity Market Operator (AEMO) recently published the 2020 Integrated System Plan (ISP) which is intended to maximise the value to end users by developing the market through an optimal development pathway. The ISP was endorsed by the Council of Australian Governments (COAG) Energy Council in 2018, and has since guided governments, the industry and consumers on investments needed for an affordable, secure, and reliable energy future.

The ISP is a 20-year roadmap for the National Electricity Market (NEM) and is updated by AEMO every two years with their response to the latest technology, economic, policy and system developments. The report identifies investment choices and recommends essential actions to optimise consumer benefits. Although the report is published by AEMO, they are not the only party to have an input in the ISP. In preparation of the 2020 ISP, an 18-month consultation program took place where over 200 stakeholders were consulted, 8 workshops were held, 3 webinars were hosted, and 85 written submissions were provided.

The 2020 Integrated System Plan

The 2020 ISP is expected to deliver approximately $11 billion in net market benefits to the NEM the next 20 years. These benefits come together with the market reform which is currently aiming to attract investments and optimise markets outcomes. The market reform is being coordinated by the Energy Security Board (ESB) with market bodies such as the Australian Energy Regulator (AER), Australian Energy Market Commission (AEMC) and AEMO.

It has been highlighted in the 2020 ISP, that as the generation mix changes with the retirement of coal generation, the least-cost transition should be through Distributed Energy Resources (DER), Variable Renewable Energy (VRE) and investment in transmission infrastructure. DER is expected to double, if not triple, providing around 13-22% of the total underlying annual energy consumption. Although, more than 26 GW of new VRE is needed to replace 63% of coal-fired generation that is set to retire.

Dispatchable resources between 6-19 GW are also needed to back up the renewable energy generators. These dispatchable resources will be in the form of utility-scale pumped hydro, fast responding gas-fired generation, battery storage, demand response and aggregated DER participating as virtual power plants. It was also highlighted that there is a growing need to actively manage power system services such as voltage control, system strength, frequency control, inertia, ramping and dispatchability.

AEMO’s Forecasted Projects

To achieve the desired results, there are several projects outlined in the 2020 ISP that were broken down into committed projects, actionable projects, actionable projects with decision rules and future projects. The committed projects are aiming to address cost, security and reliability issues and have already received regulatory approval. The South Australia system strength remediation is one of these projects, which will see the installation of four high-inertia synchronous condensers and is on track to be completed in 2021.

The Western Victoria Transmission Network Project is a two-part project due to be completed in 2021 and 2025 to support generation from the Western Victoria REZ, including new 220 kV and 500 kV double-circuit lines. The last of the committed projects is the QNI Minor which is set to be commissioned in 2021-22 and will involve a minor upgrade of the existing interconnector, adding over 150 MW thermal capacity in both directions.

Actionable Projects

The actionable projects include a minor upgrade to the existing Victoria ‒ New South Wales Interconnector (VNI), which is expected to be complete by 2022-23. There will be a new 330 kV double-circuit interconnector created between South Australia and New South Wales which is due to be complete by 2024-25. In the same year, the Central-West Orana REZ Transmission Link is set to spark network augmentations to support its development. In 2025-26, there will be a 500 kV transmission upgrade to reinforce the New South Wales southern shared network and increase transfer capacity between the Snowy Mountains hydroelectric scheme and the region’s demand centres.

Two projects that are actionable with decision rules are the VNI West project and the Marinus Link. VNI West is a new High-Voltage, Alternating Current (HVAC) interconnector between Victoria and New South Wales and the Marinus Link involves two new High-Voltage, Direct Current (HVDC) cables connecting Victoria to Tasmania, each with 750 MW of transfer capacity and associated alternating current transmission.

Future Projects

Some of the future projects include Queensland to New South Wales Interconnector (QNI) Medium and Large interconnector upgrades, three additional Queensland augmentations, three New South Wales augmentations, and two South Australian augmentations.

AEMO has forecasted a great deal of change to the NEM and Edge is looking forward to seeing the progress of the upcoming projects.

Written by: Alex Driscoll (Senior Manager, Markets and Trading)

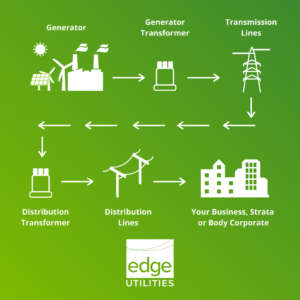

To learn more about the National Electricity Market (NEM), read our educational article: https://edgeutilities.com.au/an-introduction-to-the-nem/