A new breed of utility model is emerging with Solar PV, battery storage and artificial intelligence at its core. It is described as Social Energy, whereby a centrally controlled group of individual setups of this solar and battery combination are basketed together and placed onto the National Electricity Market (NEM) as a “Virtual Power Plant” (VPP), which is controlled by a central retailer.

The theory behind Social Energy is that it puts customers in control, by connecting their solar to approved energy storage products in the home, such as batteries, electric cars, etc. to the grid. Data intuitive AI software will then connect customers to their own virtual powerplant, giving “them,” as a collective, the power to store and trade energy earning. It claims, up to 70% savings, delivered through to their energy bill.

Customers can have a licence to describe their usage, as being from 100% renewable electricity through smart technology and future proof their usage, by having the ability to tap into future product developments, such as optimised Electric Vehicle (EV) charging (vehicle-to-grid).

This is appealing to small-scale solar owners, as subsidies have been dramatically cut through traditional government or retailer backed Feed-in Tariff (FiT) schemes in the past 5 years, whilst still contributing to the sustainability and stability of the grid. This becomes even more attractive with many retailers now coming to the party with incentives for being part of their trial periods, offering discounted batteries, including installation and interest free payments and guaranteed credit amounts.

So, what exactly is a Virtual Power Plant (VPP) and how does it work?

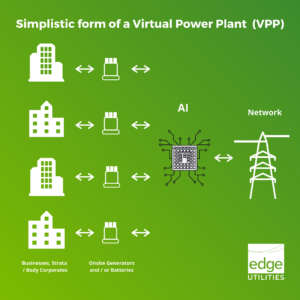

It is when you agree that a retailer has access to your battery, which is being charged from the solar panels on your roof. The retailer can remotely charge or discharge this battery as it needs to, i.e. during periods of high demand it can place this power into the grid and you will be charged for any electricity used in that time through your bill. The retailer will then pay you this amount annually as a credit, less any FiT tariff and discounts you receive.

As per above, the regulator who runs the NEM doesn’t want to be looking at 1million small batteries individually to determine should you be turned on or off? So, the retailer will basket up or combine the batteries with others in your area who are on this scheme and charge or discharge them all simultaneously, meaning you make up a VPP large enough for the grid to use your electricity.

This is a much preferable scenario for AEMO than the previous view which was that these batteries and solar combinations will remain islanded from the grid. This was highly debated a few years ago and has accelerated the investment of VPP trials especially in SA and Victoria, where the uptake hopefully can do what the Tesla battery did and reduce the likelihood of backouts.

However, how the distributed energy network can deal with this much “reverse” energy is still unknown. These networks were designed to move the electrons from the transmission lines to our houses. The world where this big, centralised energy source, such as power station, provides power to the grid, is reducing and the uptake of local energy growing what it costs there to upgrade the networks to allow for this change?

Whether the grid, or the regulators, are ready or not however, is the debatable question. Distributed Energy Resources (DER or Local Energy) is coming. They aren’t doing it quietly either and a VPP will allow them to have access to the market and all the market opportunity that comes with it.

In our opinion the only thing to slow this growth and investment in the near term, will be the distributed networks challenge in accommodating the rapid increases in this DER.