The budget handed down last night by the Albanese government really did show that there will be “hard days to come”. The treasurer, although acknowledging the international pressures and increases of electricity prices, did nothing to assist with this increasing cost on households and businesses bottom lines.

So why are international pressures a driver for the electricity we use when we turn on our lights?

Well let’s start with a breakdown of what goes into our bill, a large customer will see this split into each section, but smaller businesses and households don’t, they are just rolled into a flat tariff.

There are 4 main components of the energy we buy:

- The physical electrons / energy we purchase

- The environmental subsidies we all contribute into for a certain number of renewables to be underpinned

- The cost of running our electricity grid

- The cost of maintaining and running the infrastructure from the huge transmission lines coming across the state to the smaller distribution lines which bring the power to our business or home

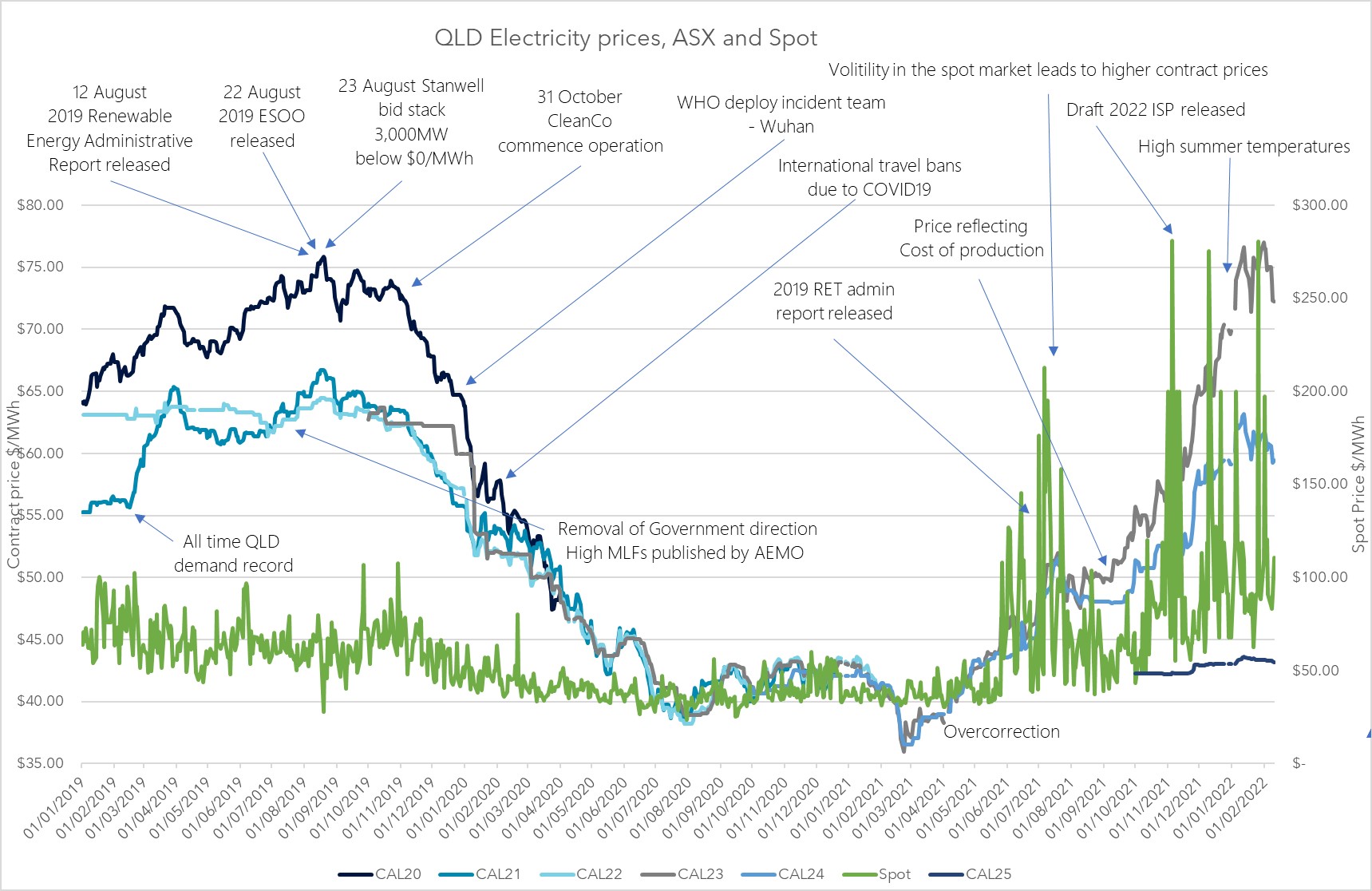

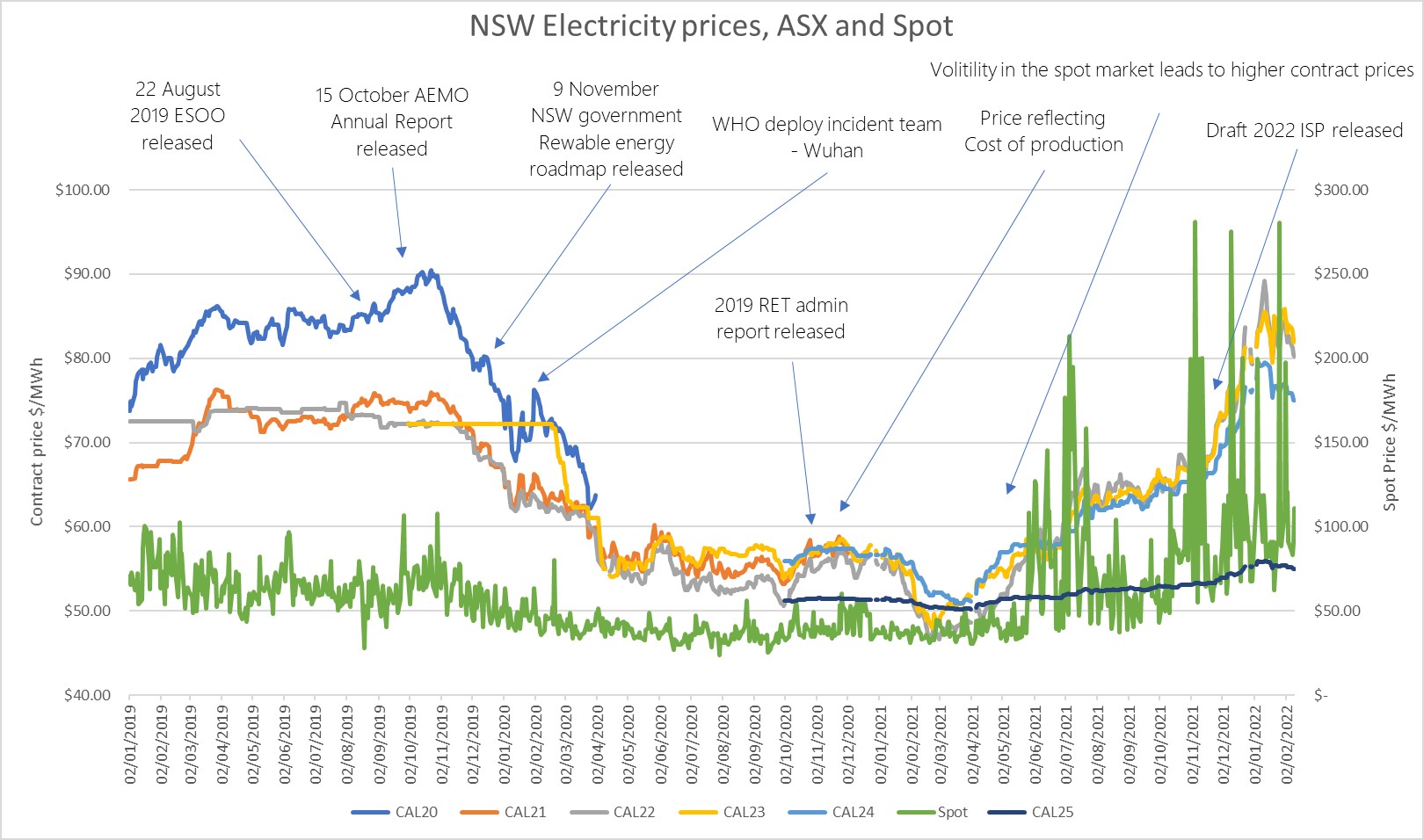

The cost of the physical power we use has been on a rollercoaster the last few years. From unprecedented lows during the pandemic, when there was little global demand for our exports and lower demand from our domestic industry to the highs we are now experiencing. But to breakdown this huge shift we have to look abroad.

Let’s first address why we are looking outside of Australia. As a country our coal and gas is largely exported into Southern Asia. Their thirst for energy has increased dramatically over the last few decades and our abundance of natural resources and location made us a great partner to feed their demand. But we are not the only ones satisfying their thirst for energy, and therefore our price of export at is linked to the price other global countries will export at. Setting the ’Global price’. It is just like us going into Coles (China) and seeing Tim Tams for $20 and knowing they are $4 in Woollies (Australia), we would always shop at Woollies. Therefore, to ensure no company misses out the price is always about the same no matter where you shop.

So, if you are an exporter of coal and you know you can sell your Tim Tams to Coles for $20, why would you supply our domestic market (Woollies) at $4/pack. You wouldn’t, you would pile all the coal (Tim Tams) you could on a ship and send it away as quick as you can, and that is why we are linked to the international market. As we need the Tim Tams (or Coal) to ensure our domestic electricity demand is met. But, to do this, we also have to pay the $20/packet to make sure we can have enough here in Australia.

This international price has skyrocketed recently. Not only has demand come back from all the lockdowns caused by COVID19, but the Ukraine crisis has thrown global energy into a tailspin. Europe, who used to be nicely fed their Oil and Gas from Russia now cannot get their supply, as such they are telling everyone they will buy the Tim Tams for $25 even $30 per packet. So again, the circle of, if I can sell to them for $30 why would I sell to Woollies for the now $20 price re starts until Woollies (Australia) is now paying $30 per packet.

But as the cost of the Tim Tams go up we start thinking maybe I will have a Kingston (Gas) instead, it is easier to buy and no one has bought them all for the next 18 months at $30/pack. So, as we all start leaving behind the expensive Coal (Tim Tams) because they have all being bought and pre-ordered for 18 months and move to Gas (Kingston’s). In doing this, that price also increases, and so the spiral re-starts.

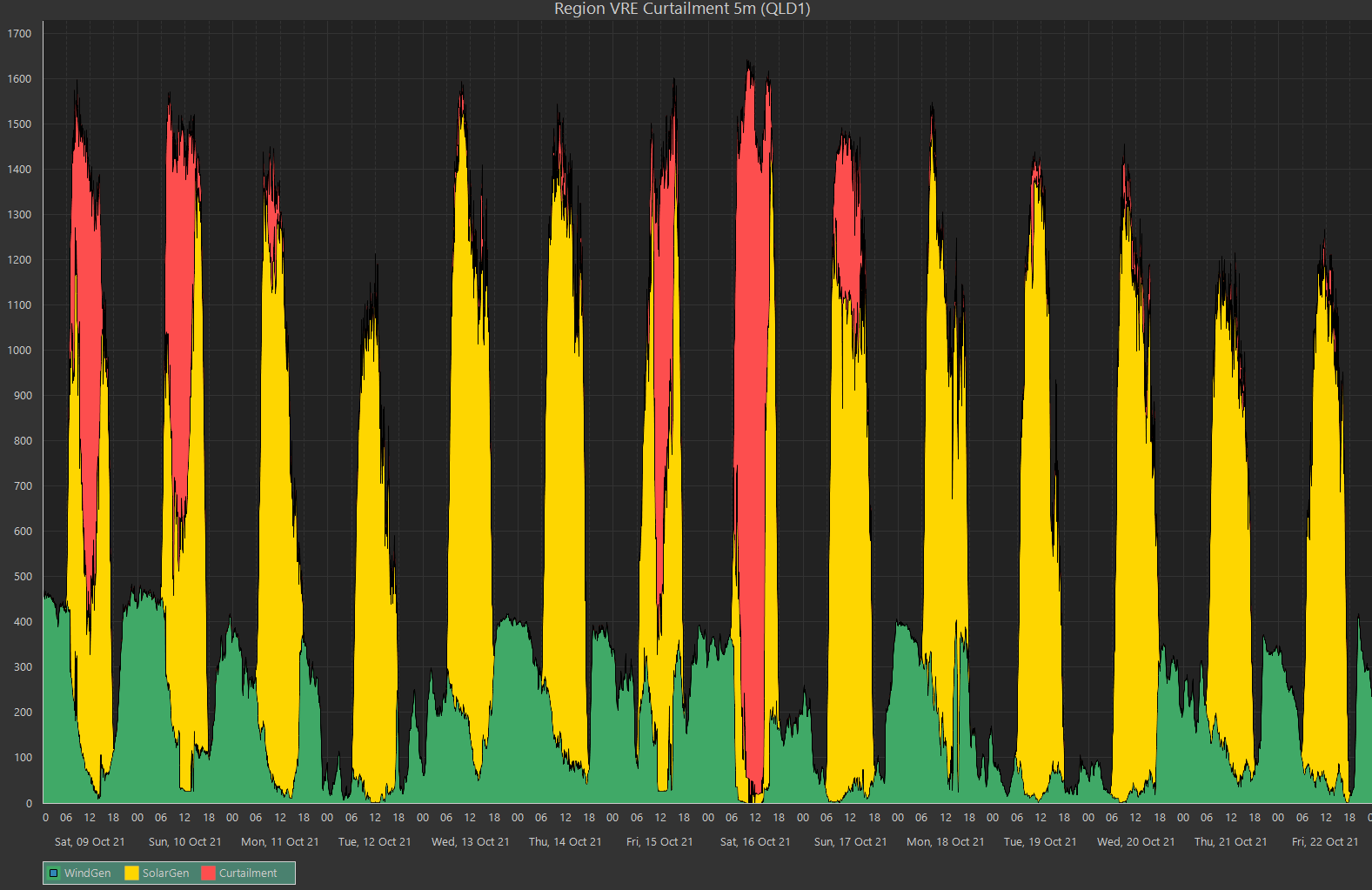

Now let’s add some spice. The delivery truck bringing those Tim Tams and Kingston’s to the shops (Power Stations) are flooded in, or the truck unloads but they all get soggy in the rain. Now they can’t be eaten (burned to make electricity). So, what happens? What was already a high price, gets higher. So, with a third La Nina forecast for Australia and flooding already affecting many regions, these deliveries are either delayed or just don’t make it. Meaning an already tight market becomes more sparce and therefore more expensive.

Now the cynical among us would say that the generators are taking advantage of this, and the market is pushing the price higher and higher because they have bought their Kingston’s and Tim Tams at $20/packet and could sell them to us at that price, but instead they know they could now charge $30 per packet so why not, they bank the $10 per packet and no one is wiser. But that is for the ACCC, and you would hope they are watching such behaviour with eagle eyes!

These are a handful of the drivers affecting our price at the moment, there are currently 7 to 10 of them all similar in their affect, that any fluctuation anywhere in the world is having huge repercussions to us at home.

But they aren’t the only changes. With huge pushes towards renewable energy and the certificates produced by them, this market is also increasing as the number of renewables is not increasing as quickly as the amount required. Therefore, again the costs go up and this is passed onto the end users in their bills. Now factor in this renewable energy is going to cost more not just now but in the future, as the cost of making the solar panels increases as the electricity price increases. Therefore, the cost of any of this de-carbonisation has just increased in price too.

But that isn’t the end of the story, finally, let’s consider the cost of bringing the power from the power station to our meter. This is a huge amount of infrastructure which is either older requiring it to be maintained or new requiring funding. Both costs are underpinned by debt. The higher the lending rate is, the higher this debt becomes and therefore the more we are charged to use their system. Further with the huge roll out in renewables this will require significant upgrades to the system as the power will be coming from less conventional areas to the load centres (think towns / cities). With the interest rates rising the cost of this debt or borrowing goes up, just like a mortgage on a house. Again, this only means one thing. An increase in pass through costs to our bills. With huge renewable ambitions and nowhere near enough funding passed down in this budget, that can only result in increases to our bills from our retailers.

Unfortunately, this means that without significant easing of many of these fundamentals, there is no relief in sight. Maybe for once the sensational headline of 35% increases in bills may turn out to hold some truth.

Edge Utilities can help:

If you feel you need to take more control of your company’s business energy spend, please reach out to discuss joining our Edge Utilities Power Portfolio (EUPP) where we use the power of bulk purchasing to help Australian businesses of all sizes save on their energy bills. Read more: https://edgeutilities.com.au/edge-utilities-power-portfolio/ or call us on: 1800 334 336 to discuss.