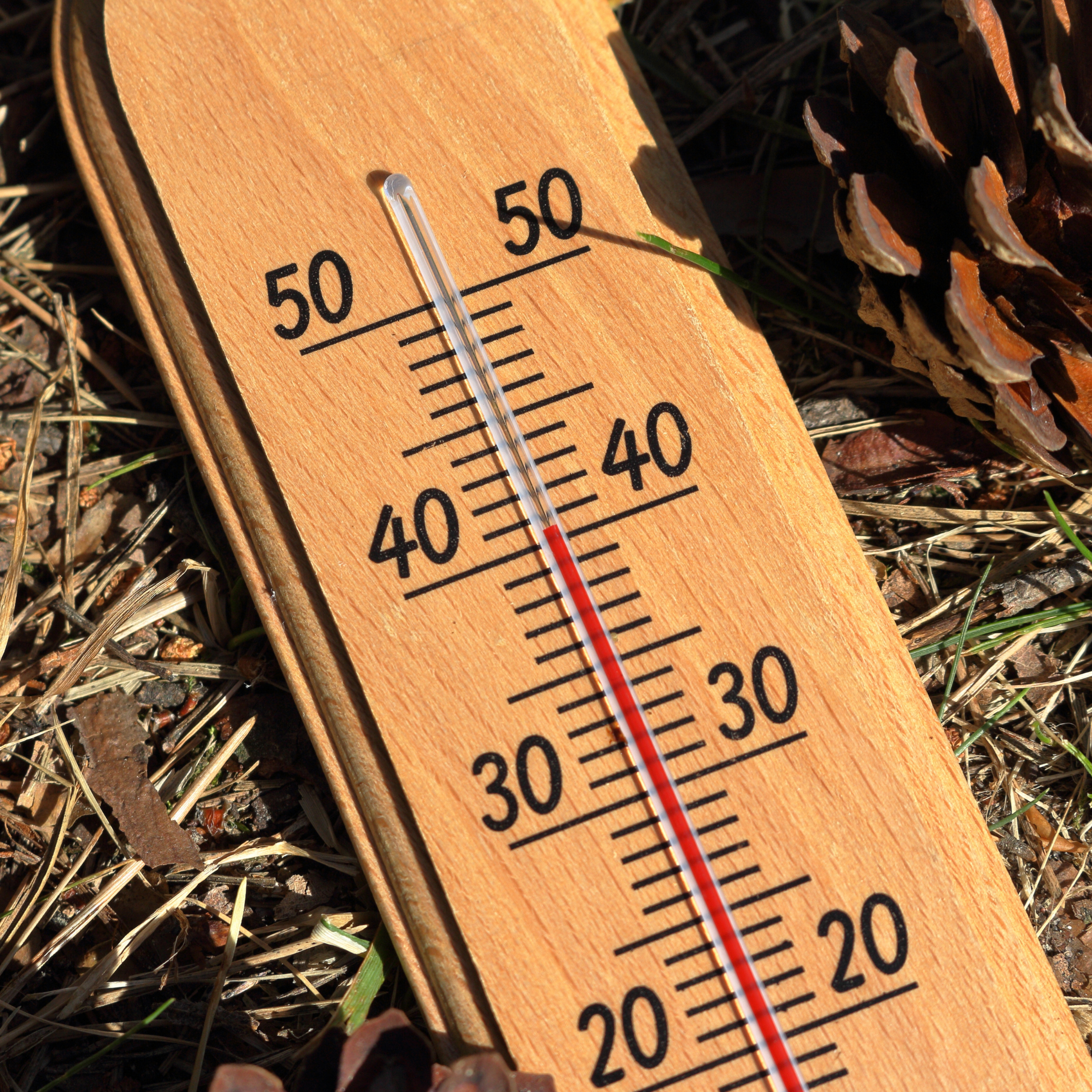

You may have heard it has been hot in Queensland over the last couple of days. Yesterday this all came to a head with the market showing some cracks.

At a high level, the spot price averaged $1,607/MWh for the day. Prices were less than $300/MW for most of the day when solar generation was high but as we moved to the evening the spot price spiked to between $10,000/MWh to $15,100/MWh for a few hours as coal, gas fired generation and pumped hydro set price.

Yesterday and again today the market is under pressure on both the supply and demand sides. For the last couple of days, the hot weather has been influencing consumption. The second part of the equation is the supply side. At the start of yesterday Queensland’s largest generator, Kogan Creek was offline as well as Callide B2. All other “baseload” units were online.

High temperatures and particularly high humidity impact the output from coal and gas fired generation. Coal units generally vacuum unload over the evening peak if they have not been proactively managed by the operators, which AEMO is fully aware of and is built into the contingency. Another issue with Kogan Creek being offline is that it reduces the flow across the QLD to NSW Interconnector (QNI), the result flows from NSW and is generally capped at ~600MW.

Adding to the already tight supply balance, the Tarong Power Station Unit 2 tripped at 15:15, returning to service at 18:50. Tarong 2 was ramping up at the time of the trip and from the trip profile, it does not look like a tube leak. From 18:50 the unit ramped up over the next couple of hours and is now running normally. Shell also had plant issues at the 78MW Condamine Power Station, taking the unit offline. Tarong, Millmerian, Stanwell and Gladstone Power Stations also had one or more issues over the evening peak.

An Intervention Event was triggered as a result of Reliability and Emergency Reserve Trader (RERT) being implemented in Qld. This took effect from 17:00 01/02/22 until 21:30. Intervention pricing took effect from 17:00.

A Lack of Reserve (LOR3) is still active for today as RERT has not been extended to manage today’s evening peak. If RERT is extended or reinstated today the LOR3 will be cancelled.

As part of RERT, Powerlink was asking for industry to reduce consumption if safe. Large mines in Queensland have historic agreements with Ergon to reduce consumption and on this occasion, they reduced load as requested.

In the build-up to the evening peak, the Minister for Energy, Renewables and Hydrogen and Minister for Public Works and Procurement, the Honourable Mick de Brenni made the statement “It is possible that Queensland’s previous record demand of 10,044MW will be exceeded on either today or tomorrow.”

Queensland’s demand peaked at 16:40 as a result of the demand side management.

At 21:30 AEMO published a market notice letting the market know that the intervention event had ended and as a result, RERT and Intervention pricing was not continuing.

So what is ahead for us today?

- Demand forecast is looking to peak close to 10,000MW today, this is forecast to occur at 17:00.

- Pre dispatch spot pricing is again forecast to be at $15,100/MWh between 14:00 and 23:00.

- RERT may be needed again today and AEMO will currently be exploring their options.

Written by Alex Driscoll Senior Manager Markets, Trading & Advisory