Is this the first move for major changes in the energy industry?

Is this the first move for major changes in the energy industry?

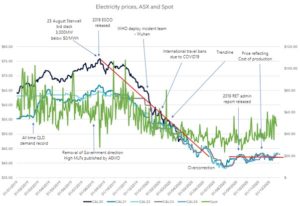

We have discussed the impact a changing energy industry is having on the Queensland Government owned energy companies and the impact on AGL. Generation, transmission, and retail companies are producing lower profits and their assets are being written down in value due to the subdued electricity prices going forward.

AGL Energy has been the first company to raise the option of breaking itself up as it positions itself to operate in a landscape of low electricity prices. Driven by the State and Federal Governments underwriting new clean generation, resulting in the high penetration of renewable energy in the National Energy Market (NEM). With this also comes a shift toward a decarbonised generation fleet to meet customers’ requests for low carbon and renewable energy.

With profits dropping 27%, AGL has cut its spending and costs after a first half loss of $2.29 billion. AGL have also revisited their future expectation and now they predict that prices will remain low into the future because of the increase in renewable generation in the market.

A Gentalier is a company that is vertically integrated from its generation through to retail.

The key reasoning for breaking up AGL and other similar businesses is that they operate as a Gentailer. This model has been very successful for many years with the Gentailer generating cheap power from coal fired power stations and selling to its retail customers at a premium price. With the change to the generation mix various parts of the Gentailers have opposing drivers. Companies like AGL and the Queensland Government owned generators have large fleets of coal fired generation and relatively small amounts of renewable generation. But, the customers want to source their power from renewables.

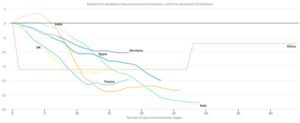

Overseas energy companies have responded to the opposing challenges and have split their businesses between customer focused solutions, large scale renewable generation and the carbon intense coal and gas fired generation fleet. The carbon intensive parts of their businesses have been generally separated from the core business to allow the carbon intensive assets to be retired over time.

Breaking up their business into the retail company and the generation company is another option like the structure across Australia before vertical integration.

A third option is to create two retail front ends.

- One backed by clean energy and

- One backed by carbon intense energy.

Depending on the price point, the clean energy retail would flourish and the carbon intense business would diminish. While all this talk of different business structures is circulating it is likely that future retail solutions will also include other products like telecommunications and internet. All provided as the one package with electricity from one retailer.

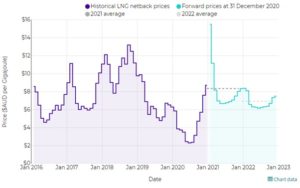

In another signal to the changing landscape, AGL have identified $150 million of operating cost savings to deliver in 2021-22, with $100 million reduction of stay in business capital expenditure between now and 2023. An increased growth budget to focus on battery investments and the Crib Point LNG import terminal in Victoria. The cost of LNG and investment in new gas fired generation is also on hold as AGL investigates the details of New South Wales Government’s energy infrastructure road map.

Is this the first move for major changes in the energy industry?

Is this the first move for major changes in the energy industry? “Going green” has so many benefits – not just your local area but for the whole planet. Having green credentials is also great for your corporate social responsibility and is something you can brag about on your website.

“Going green” has so many benefits – not just your local area but for the whole planet. Having green credentials is also great for your corporate social responsibility and is something you can brag about on your website. Over the last couple of years solar was the hot topic when discussing projects. Now battery storage is what everyone is talking about. From large scale projects, to smaller scale installations on the roof of households, commercial businesses, such as factories and now solar shaded car parks! Batteries are the new option everyone wants.

Over the last couple of years solar was the hot topic when discussing projects. Now battery storage is what everyone is talking about. From large scale projects, to smaller scale installations on the roof of households, commercial businesses, such as factories and now solar shaded car parks! Batteries are the new option everyone wants.

Hydro Tasmania have signed its first deal for the energy stored in its system.

Hydro Tasmania have signed its first deal for the energy stored in its system. Origin Energy wants to build Australia’s largest battery, announcing a 700MW battery to be built in the NSW Hunter region.

Origin Energy wants to build Australia’s largest battery, announcing a 700MW battery to be built in the NSW Hunter region.

et (NEM) is near impossible. But a solid understanding of the fundamentals is essential if you stand any chance of knowing some of the more complex aspects of it.

et (NEM) is near impossible. But a solid understanding of the fundamentals is essential if you stand any chance of knowing some of the more complex aspects of it.