A constraint designed to maintain power flow in the Gladstone region, primarily to maintain the continuous current rating on the 132kV feeder bushing at Boyne Smelter, is constraining off hundreds of MWs in Queensland.

A constraint designed to maintain power flow in the Gladstone region, primarily to maintain the continuous current rating on the 132kV feeder bushing at Boyne Smelter, is constraining off hundreds of MWs in Queensland.

Constraints on the interconnectors out of Queensland are also limiting QLD generation. A constraint to avoid voltage instability on the Sapphire to Armidale 330kV transmission line is reducing NSW generation.

Constrained gas supply is also impacting spot prices. BHP’s Gippsland Basin joint venture with Exxon in Victoria, is not operating at full capacity due to a processing train at the Longford plant out of service since 28th June. This was due to an unplanned maintenance issue.

The unplanned issue at Longford has also reduced the output from the Bass strait gas fields that feeds the plant. The Iona gas storage facility operated by Lochard Energy is also running low.

The reduced level of generation from coal fired generation, resulting from the loss of Callide power station, the delayed return of Callide C3, and the reduced output of Yallourn in Victoria due to flooding have all added to the extra requirement for gas powered generation in QLD and VIC.

The requirement for extra gas-powered generation has led to higher prices in the gas market, which in turn leads to higher dispatch prices of the gas-powered generation. Higher dispatch prices lead to higher spot prices.

Domestic pressures on gas prices on the Australian wholesale market have been impacted by the overseas gas market demand and prices. As the Australian gas market is export dominated, any changes to overseas prices are reflected domestically. The benchmark Japan Korea Marker (JKM) is linked to the LNG netback price.

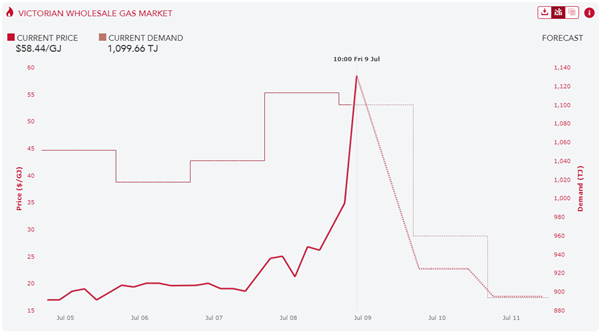

The JKM is also used as a floor for gas contracts in Australia and with the JKM lifting to $19/GJ this reflects in Australia. Today the Declared Wholesale Gas Market (DWGM) prices in Victoria is $58.44/GJ with a demand of 1,100TJ.

The futures market has responded to this week’s higher spot prices, along with the announcement that Callide C4’s return to service would be delayed until the end of 2022. The unit was planned to be in service by the end of 2021 and capable of supplying power over the 2021 summer however, the delay has pushed up the Q122 quarter prices as well as most of the quarters until 2023.