Australia it seems is not immune to the Retailer of Last Resort (ROLR) process which has been plaguing the European energy market for the last few years. Germany is discussing bailouts for Uniper SE, the French Government is talking about fully nationalising Électricité de France SA. The UK has seen over 30 electricity providers go into Retailer of Last Resort in the past few years, a gas shipper backed by Glencore go under, and have put Bulb Energy under the government’s control.

The Australian market isn’t immune either with Mojo just the latest retailer to enact the Retailer of Last Resort mechanism for its 500 customers.

So, why are so many companies buckling under the current energy crisis and what can you do to avoid being wrapped up in the process?

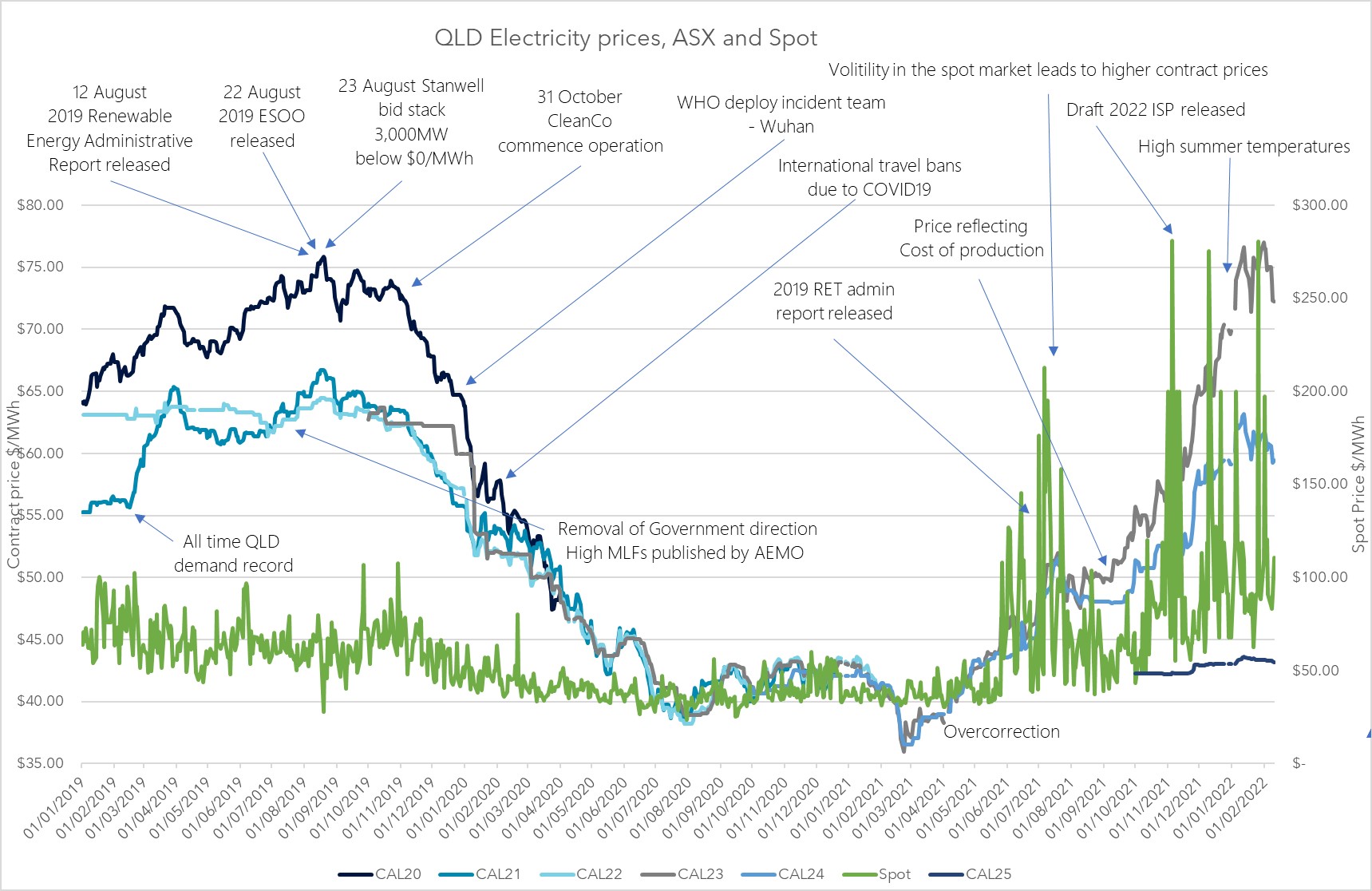

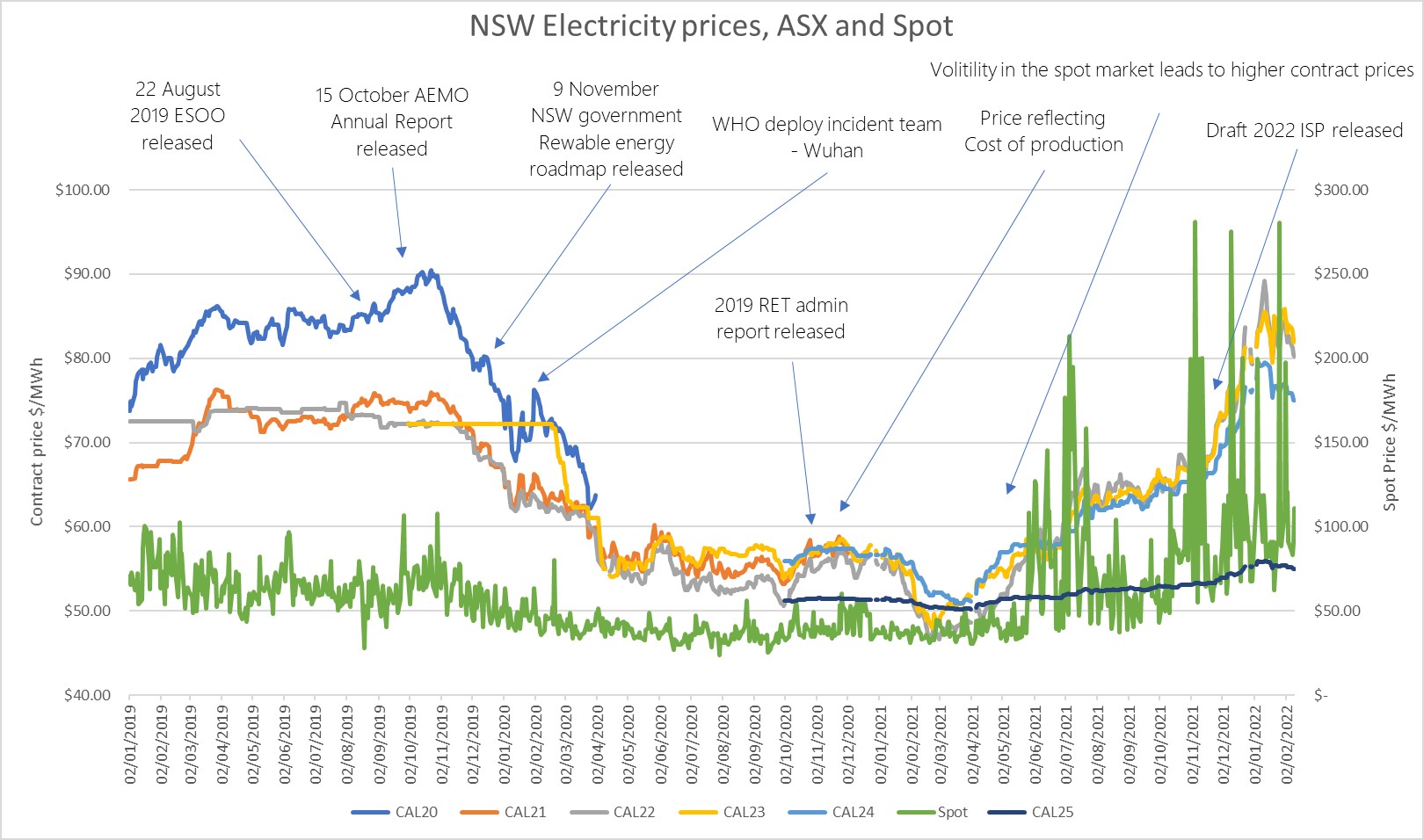

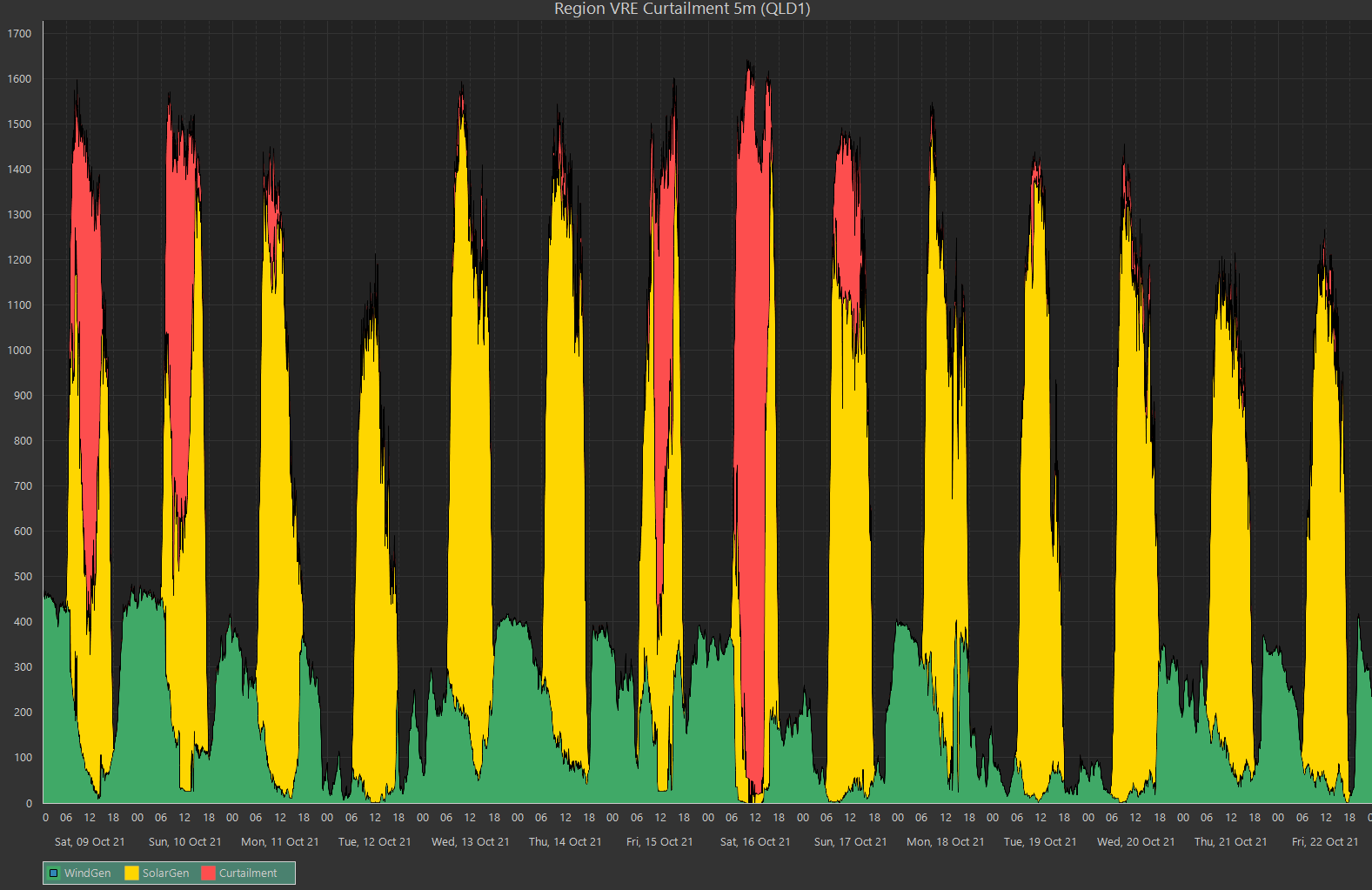

The squeeze of the energy markets is due to many factors, including the war in Ukraine and sanctions on Russian Oil and Gas reducing availability, catastrophic flooding affecting the mines and rail tracks from our own domestic coal supply and in our opinion some generators ensuring they are well placed to benefit from any perceived shortness of supply. All these factors have pushed the price of our domestic electricity and gas to unprecedented levels, and we are not the only ones. With Europe at 6 to 8 times higher than the last 5 years average there is no easing of international fundamentals pressure.

This should lead to higher prices on our bills, however, if a retailer has not adequately protected their position and are exposed to these prices, they cannot simply pass them through to the end user. Some consumers are protected by the Default Market Offer, this is the maximum that you can be charged on your bill, and it applies to mums and dads and small businesses with solar installed.

That isn’t a problem, is it? Well, if these retailers have not ‘hedged’ or bought the electricity contracts for their customers, before prices went up 6 to 8-fold, and they cannot pass through these higher charges, then they are no longer in a viable position to continue as a business and must call in a Retailer of Last Resort to take their customers and close. The customers who are passed to a new retailer then risk being passed through on a more expensive tariffs or variable tariffs.

With increasing interest rates globally eating into all aspects of businesses profitability and further possible energy price spikes, as retailers look to pass through as much of their costs as they can, we do not believe Mojo will be the last to shut its doors.

So how can you protect yourself from being exposed to variable pricing or smaller retailers in this market? Well, there are several ways:

- Ensure you have a reputable retailer, the EUPP only works with the top tier retailers who have sound strategies to hedge their longer-term positions, either through generation or trades.

- We ensure that all costs are either agreed at the start of the contract or passed through with no uplifts, and the allocation of these pass-through costs is fair.

- Finally, the EUPP puts you into a larger group of buyers of electricity, allowing your company to benefit from access to retailers and contracts usually only available to the larger market.

All this coupled with the expertise of the energy managers, who manage your energy portfolio to ensure it keeps up with the market and defend your portfolio in this volatility.

If you feel you need more control of your company’s energy spend, please reach out to discuss joining our Edge Utilities Power Portfolio (EUPP) where we use the power of bulk purchasing to help Australian businesses of all sizes save on their energy bills. Read more: https://edgeutilities.com.au/edge-utilities-power-portfolio/ or call us on: 1800 334 336 to discuss.