The world is changing……………………. you only had to look out the window this week, to see the impacts of this.

No matter how you think it is occurring or who you think is contributing to it, climate change is real.

Over the last decade it has been more evident that Australia is being impacted by climate change. We have seen higher temperatures, worsening droughts and most recently parts of Australia have been impacted by the worst floods in a decade.

Australia has always been affected by extremes in the weather, but science shows the impact and regularity is increasing.

At Edge part of our role is to advise our clients on how to best manage risk. This is not always financial risk as most people would assume but, indirectly climate risk. This is the biggest risk many companies are facing, and this directly relates to financial risk.

Investors are starting to push companies to align their operations towards emission reduction targets and the use of sustainable practices. Many companies across Australia are pledging to reduce emissions to ‘‘net zero’’ by 2050 however, many do not have a clear strategy to reach this target.

Edge has and is currently assisting our clients with the development of low carbon business models.

When investors are weighing up the performance of a company, they are now allocating more weighting to how the company manages it sustainability.

Edge works with a range of clients including, some of the largest mining and utility companies worldwide and over the last couple of years we have developed strategies to decarbonise their businesses.

The procurement of renewable energy is just one way in which Edge is assisting clients.

We have developed sophisticated mechanisms to provide the client with access to:

- renewable energy

- environmental certificates

- emission offsets

and……………..we are still able to manage the price risk and uncertainty in the energy market.

Following feedback from industry that gas is not the transitional fuel for Australia to help move from Coal fired generation to renewables, AEMO is grappling with their plan to model a ‘gas led recovery’ scenario for the 2022 Integrated System Plan (ISP).

Following feedback from industry that gas is not the transitional fuel for Australia to help move from Coal fired generation to renewables, AEMO is grappling with their plan to model a ‘gas led recovery’ scenario for the 2022 Integrated System Plan (ISP).

et (NEM) is near impossible. But a solid understanding of the fundamentals is essential if you stand any chance of knowing some of the more complex aspects of it.

et (NEM) is near impossible. But a solid understanding of the fundamentals is essential if you stand any chance of knowing some of the more complex aspects of it. Intertwined with Christmas and New Year celebrations, Edge2020 capped off the ‘year that was’ with excellent news regarding a 58MW renewable power purchase agreement (PPA) we brokered, and the re-signing of our longest serving and largest client.

Intertwined with Christmas and New Year celebrations, Edge2020 capped off the ‘year that was’ with excellent news regarding a 58MW renewable power purchase agreement (PPA) we brokered, and the re-signing of our longest serving and largest client.

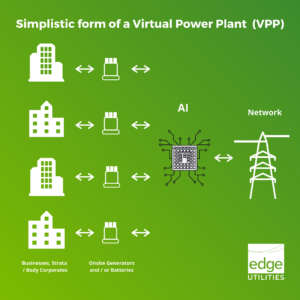

Many of you would have seen the acronym VPP floating around the energy industry, in AEMO documents and publications like the Integrated System Plan (ISP). So, what is a VPP? A Virtual Power Plant (VPP) is basically an aggregation of resources. These can be generation, storage and controllable load from decentralised sources. All being coordinated to deliver services to the power grid including electricity, FCAS and other power system services.

Many of you would have seen the acronym VPP floating around the energy industry, in AEMO documents and publications like the Integrated System Plan (ISP). So, what is a VPP? A Virtual Power Plant (VPP) is basically an aggregation of resources. These can be generation, storage and controllable load from decentralised sources. All being coordinated to deliver services to the power grid including electricity, FCAS and other power system services.