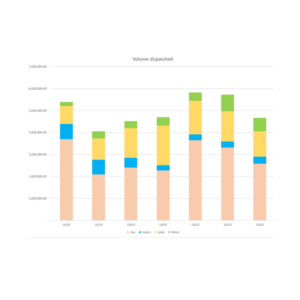

Much has been discussed about the penetration of renewables and whether they will be able to give valuable returns by a grid needing significant infrastructure upgrades. However, the bigger question to be discussed is with the carve out in prices, a deepening duck curve and an exponential growth in renewables, is the value still there for investors?

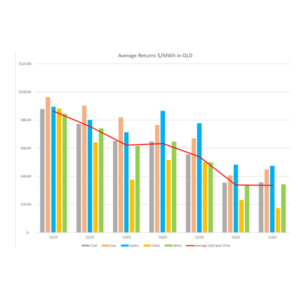

You can see in Queensland almost daily how in a raw (non-loss factor adjusted) form, the value has been eroded from the high penetration, low demand periods over the middle of the day, traditionally when Solar is highest.

What cuts a real blow to the Solar Farm operators on this spot return is that to at best match, and at worst achieve, half the $/MWH returns of wind and around a third that of Hydro they are producing, almost double the MW of Wind and 4 times as many MW as the Hydro plants.

So, with reducing Marginal loss factors (MLFs), diminishing returns and solar carve out resulting in negative prices most of the time in Queensland, how is the uptake of solar specifically growing at such a rate?

With Corporate Power Purchase Agreements (PPAs) firming this shape at a cost comparable to those seen in this already depressed market and social licence becoming a bigger driver for the states largest users, could the answer be in the technology and social pressure and not the cost?

With Copenhagen Climate Change Conference, COP-15 going ahead in October and although fizzling a little from expectations with no binding agreement on emissions reductions, agreed it did ensure continuing pressure is being placed on governments not only to meet their Paris agreements, but accelerate their national economies transitions to this technology. Investors are hedging not only will the public start asking questions, but the government may also be in a position where they must.

Therefore, the natural belief is that into the future, will we see the requirement for renewable sources of electricity increase? With many companies already vying to be first from the gate to announce partnerships with green retailers and many traditional retailers diversifying their portfolios, is it any surprise that the renewable race continues?

The question therefore needs to be changed. How can the countries and individual states, rich in renewable resources and primed to lead on renewable generation avoid creating an exacerbated super peak due to intermittent generation?

The answer comes in the form of energy storage. This could be from the older technologies, Coal and Gas plants, although their ramp up rates are quite rigid and therefore cannot be able to instantly react to the intermittency of renewables. So now we look to Hydro and Battery as almost instantaneous ways to support the transition to a low carbon economy. Yet their attention is elsewhere now. These technologies are being underpinned in financial close and funding by the promise of Frequency Control Ancillary Services (FCAS) dividends.

With the prize being large and potentially growing in this market, could the very technology that could help dampen the price volatility withhold their support and cash in on the ensuing opportunity? Without strong government regulations, incentives and market structures, investors will naturally look to capitalise on an available arbitrage and with succeeding governments having non-cohesive policies and regulations affecting the viability of these projects. Securing as much cost revenue as quickly as possible has to be attractive to these companies.

It sounds like this is all doom and gloom, it really isn’t. Properly managed and supported by changes in behaviours of consumers can lead to a successful grid with real benefits. However, this will never come from the private sector without governments paving the way. Without a strong backbone of regulations and market infrastructure and financial structures the investment may come but if too slow at what cost will this be to the consumer.

In the medium term we can expect to continue to see the diversification of the energy mix but also a significant growth in storage. This is due to the former creating significant oversupply of energy created by the non-dispatchable generation. By utilising this within storage it will help the companies maximise the returns of that technology into more useful (and lucrative) times of the day. This however doesn’t have to be only in the form of batteries. Think of anything that can hold the potential energy.

Hydrogen for instance can be made with green technologies and then used to generate in the peaks of the day. Although the cost of Hydrogen at the moment is significantly larger than the rate of return achievable if it can be utilised in this way, it could bring the cost closer and with government subsidies this could become a viable option. Another alternative is Pumped hydro, which can be used to fill in the negative and cheaper parts of the day increasing the demand and usage and then stored until needed for dispatch over the peaks.

There are also newer technologies being developed and emerging, such as Liquid Air Energy Storage (LAESA) which compresses air into liquid during times of low demand, then when the demand and price increases the liquid can be re-transformed into a gas and pushed through a turbine which allows zero-carbon electricity to be placed onto the grid.

All this technology and the rapid development and increase in investment can only be good for renewables. It allows this lower cost but non-dispatchable, more established technology to underpin the decarbonisation, whilst keeping costs as low as possible throughout the day not just when the sun is shining, or the wind is blowing.

Unfortunately, we are not there yet and are still heavily reliant on the traditional forms of dispatchable generation for balancing. How quickly this will change, will come down to regulation, investment and the drive of companies both internally and from external pressures.