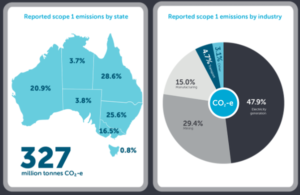

Last Thursday the Clean Energy Regulator (CER) published the latest National Greenhouse and Energy Reporting (NGER) data outlining the largest 400 emitters across Australia.

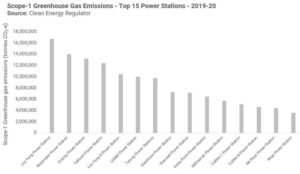

As expected, Australia’s energy companies ranked highest in the list with AGL leading the list, with greenhouse gas emission reported as 42.2 million tonnes of scope-1 emissions for 2020 financial year. AGLs emitter was more than double that of the second highest emitter Energy Australia, at 17.9 million tonnes.

Other high emitters included:

- Origin Energy with 16 million tonnes

- Stanwell Corporation and CS Energy emitting a combined 30.3 million tonnes.

Following the list dominated by thermal generation came the oil and gas producers.

- Chevron Australia emissions equaling 10.2 million tonnes

- Woodside Petroleum reported 9.2 million tonnes

- Santos emitting 7.3 million tonnes

As AGL owns the oldest and dirtiest power stations due to the fuel they burn, it is not surprising they top the list of emitters with 8% of Australian greenhouse gas emissions.

AGLs largest emitting stations was the brown coal fired Loy Yang A coal power station with 16.7 million tonnes and Bayswater Power Station at (14.0 million tonnes), which burns black coal.

With the release of these results, it will put increased pressure on the retailers to clean up their generation by moving towards renewable generation.

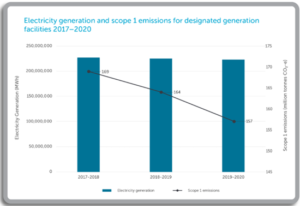

Emission reductions have changed across various sectors in the 2019-20 year, which was mostly due the impact of COVID-19 however as seen below the electricity generation sector had continued a historic trend of reduced emissions due to the higher penetration of renewables.

Emissions from the electricity sector dropped by 7.5 million tonnes compared to the previous year. Emissions from the oil and gas sector dropped by 3.4 million tonnes as result of reduced venting and flaring of gas.

et (NEM) is near impossible. But a solid understanding of the fundamentals is essential if you stand any chance of knowing some of the more complex aspects of it.

et (NEM) is near impossible. But a solid understanding of the fundamentals is essential if you stand any chance of knowing some of the more complex aspects of it.

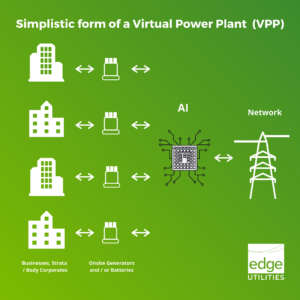

Many of you would have seen the acronym VPP floating around the energy industry, in AEMO documents and publications like the Integrated System Plan (ISP). So, what is a VPP? A Virtual Power Plant (VPP) is basically an aggregation of resources. These can be generation, storage and controllable load from decentralised sources. All being coordinated to deliver services to the power grid including electricity, FCAS and other power system services.

Many of you would have seen the acronym VPP floating around the energy industry, in AEMO documents and publications like the Integrated System Plan (ISP). So, what is a VPP? A Virtual Power Plant (VPP) is basically an aggregation of resources. These can be generation, storage and controllable load from decentralised sources. All being coordinated to deliver services to the power grid including electricity, FCAS and other power system services.