The Victorian government has introduced a Zero Emissions Vehicle (ZEV) Subsidy. The subsidy is designed to reduce the cost of purchasing an ZEV. ZEV’s, which are more commonly known as Electric Vehicles (EVs) are increasing in popularity and the Victorian government would like to see Victorians choosing to buy an EV sooner. Buyers of electric and hydrogen vehicles will be subsidised with the goal of achieving half of all new cars sold to be zero-emission by 2030.

The subsidy is part of the Victorian Government’s Zero Emissions Vehicle Roadmap, a $100 million plan to fast track the transition to ZEVs. To achieve the 50% ZEV target, $46M of funding has been allocated to support the purchase of 20,000 ZEVs. The first round includes 4000 subsidies of $3,000 to reduce the up-front cost of an EV. Further rounds will subsidise a total of 20,000 EVs over the next three years.

Victorian residents and businesses can apply for the first round of the subsidy, with electric or hydrogen vehicle purchases up to $68,740 before on-road costs eligible for the subsidy. More expensive EVs, hybrids, zero-emission motorcycles or heavy vehicles are not eligible at this stage.

The Victorian government has also committed to buying $10M worth of zero-emissions cars over the next three years, this will equate to about 400 vehicles. $19M of funding has been allocated to building 50 EV charging station throughout Victoria.

Previously, the Victorian Government released plans to tax EV drivers 2.5 cents per kilometre driven each year to counteract the expected loss from fuel excises.

An average driver covers 15,000km each year so, the extra 2.5/Km would cost EV drivers an extra $375 each year on top of registration. These changes will take effect from July 2021.

Earlier in the week Richard announced that Stanwell had long term plans to transition from a largely coal fired generator to a renewable energy and storage business.

Earlier in the week Richard announced that Stanwell had long term plans to transition from a largely coal fired generator to a renewable energy and storage business.

Following feedback from industry that gas is not the transitional fuel for Australia to help move from Coal fired generation to renewables, AEMO is grappling with their plan to model a ‘gas led recovery’ scenario for the 2022 Integrated System Plan (ISP).

Following feedback from industry that gas is not the transitional fuel for Australia to help move from Coal fired generation to renewables, AEMO is grappling with their plan to model a ‘gas led recovery’ scenario for the 2022 Integrated System Plan (ISP).

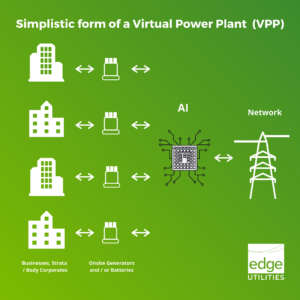

Many of you would have seen the acronym VPP floating around the energy industry, in AEMO documents and publications like the Integrated System Plan (ISP). So, what is a VPP? A Virtual Power Plant (VPP) is basically an aggregation of resources. These can be generation, storage and controllable load from decentralised sources. All being coordinated to deliver services to the power grid including electricity, FCAS and other power system services.

Many of you would have seen the acronym VPP floating around the energy industry, in AEMO documents and publications like the Integrated System Plan (ISP). So, what is a VPP? A Virtual Power Plant (VPP) is basically an aggregation of resources. These can be generation, storage and controllable load from decentralised sources. All being coordinated to deliver services to the power grid including electricity, FCAS and other power system services.